5 ways an in-store card can make your workday easier

Time is everything in today’s fast-paced work environment. Between managing projects, meeting deadlines, and keeping teams on track, finding extra time for tasks like office supply runs can feel impossible. But what if there was a way to simplify the business shopping experience, save precious time, and even take the hassle out of expenses?

This is where an in-store card can help.

In a nutshell, an in-store card charges back to your business’s line of credit. It’s a powerful little tool that is more than just a convenient way to pay for supplies — it’s a strategic asset that can unlock a world of benefits for businesses and employees.

1. Simplify in-store shopping

Say goodbye to scrambling to find company credit cards, juggling petty cash, or dealing with out-of-pocket expenses. With an in-store card, employees can breeze through the checkout, knowing that everything will be automatically charged back to the business’ line of credit.

This streamlined process can save valuable time, reduce paperwork, and minimise the risk of errors. Whether someone needs to grab last-minute groceries for a team lunch or urgently restock office supplies, an in-store card empowers teams to make quick purchasing decisions and get back to work, faster.

2. Gain control over expenses

Keeping track of every purchase can be a logistical nightmare. But with an in-store card, finance teams have complete visibility into their business’ spending. By consolidating multiple purchases with a single card, they can simplify expense tracking and record-keeping, say goodbye to piles of invoices, and no longer worry about different payment methods.

Businesses can even set spending limits for individual cards, track purchases in real-time, and generate detailed reports to identify areas where they can optimise spend. This level of transparency empowers finance teams to make informed decisions, efficiently allocate resources, and ensure that every dollar spent is aligned with business goals. An in-store card is all about saving valuable time and resources.

3. Empower teams

Imagine the frustration of spending precious work hours heading to the store, hunting down the right supplies, and then getting stuck dealing with out-of-pocket expenses. An in-store card eliminates these obstacles, empowering employees to be proactive and keep business supplies stocked, ensuring a smooth workflow. With a simple swipe, they can grab the items they need and get back to business, knowing that everything is taken care of. This streamlined process can reduce stress, improve efficiency, and boost overall team morale.

4. Unlock financial flexibility

An in-store card that charges back to a business line of credit provides much-needed financial flexibility. It’s like a pre-approved amount of money that can be accessed and used as needed, similar to a credit card. This is particularly useful when it comes to managing unexpected expenses or taking advantage of time-sensitive opportunities.

Let’s say you need to stock up on food or beverage for an impromptu work event. With an in-store card and a line of credit, you can make the purchase without worrying about exceeding your budget or waiting for reimbursement. You simply pay with the card, and the cost is automatically charged back to your business line of credit. This flexibility allows you to make quick decisions and keep your business running smoothly, even when unexpected situations arise.

5. Improved budgeting and forecasting

With an in-store card attached to a line of credit, businesses can get a clearer picture of spending with online account management tools. Through detailed reports, spend limits and real-time transactional data, finance teams have greater spend visibility. Which, in turn, helps businesses make smarter budgeting decisions and improve financial forecasting.

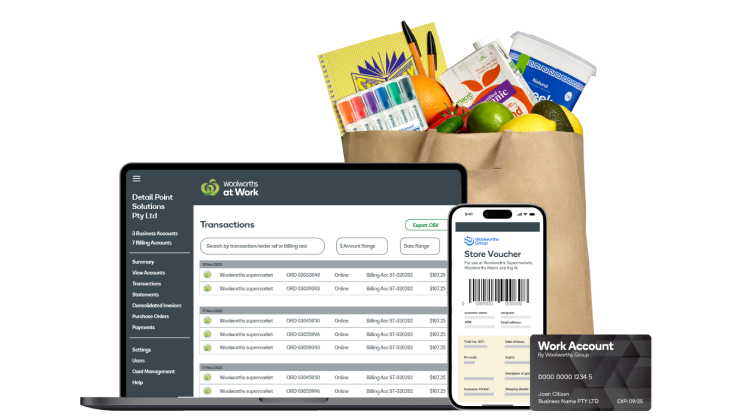

Woolworths at Work offers a solution for businesses with Work Account – a line of credit offering access to in-store cards and vouchers for you and your team, providing numerous benefits that can enhance your financial management and drive growth.

Interested in a free in-store card for your business with zero fees and interest? Apply for our Work Account Card and see how shopping in-store works easier.

Not a customer yet? Sign up now

*The information in this blog is intended to be general in nature and is not personal advice. It does not take into account your objectives, financial situation or needs. To decide if the product is right for you, you should consider the appropriateness of the information provided and the nature of the relevant product having regard to your individual requirements.